Bitcoin, as the leader in the world of cryptocurrencies, has always captured significant attention. With each cycle of price rises and falls, many questions arise about Bitcoin’s future. One of the most pressing questions is when and what factors will trigger the next Bitcoin “Bull Run.” In this article, we’ll explore the elements that could lead to a new Bitcoin Bull Run, examine the current market situation, and look into predictions.

What is a Bull Run?

In financial markets, the term “Bull Run” refers to a period of rising prices where investors have increased confidence in the market, leading to more buying activity. These periods are typically characterized by higher trading volumes and widespread media attention. In the world of cryptocurrencies, Bull Runs usually coincide with sharp increases in the prices of Bitcoin and other digital assets.

History of Bitcoin Bull Runs

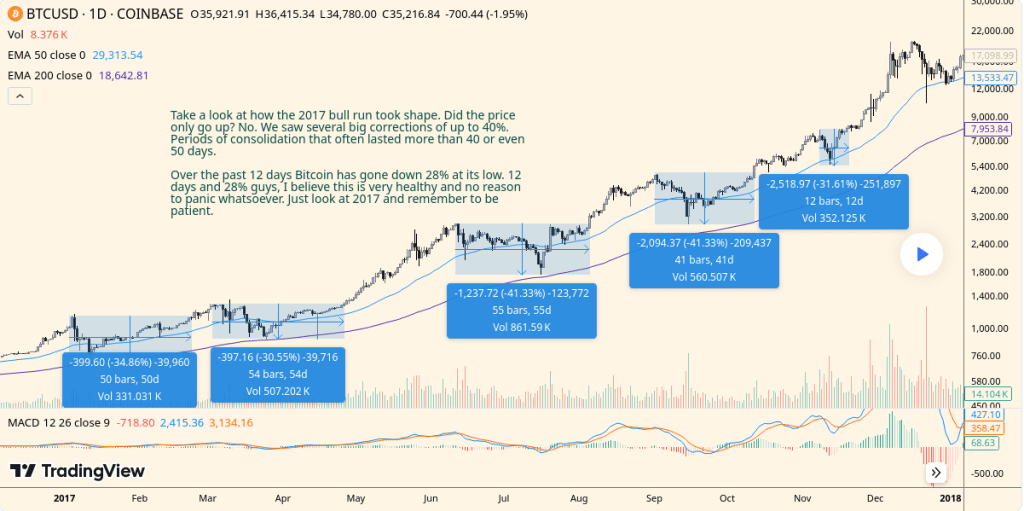

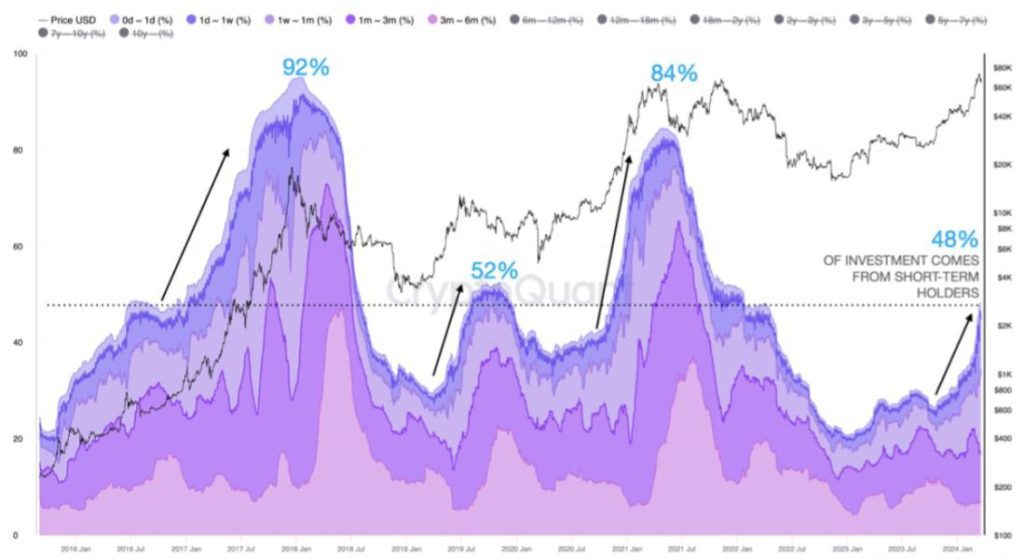

Since its creation in 2009, Bitcoin has experienced several Bull Runs. These periods have been driven by various factors, including increased adoption, technological innovations, and even global events. For instance, the 2017 Bull Run, which saw Bitcoin’s price surge to over $20,000, marked a significant milestone in cryptocurrency history. Similarly, in 2020 and 2021, Bitcoin underwent another Bull Run, pushing its price above $60,000.

Factors Influencing the Next Bitcoin Bull Run

- Wider Bitcoin Adoption One of the key factors that could trigger the next Bitcoin Bull Run is broader adoption by companies, financial institutions, and even governments. With major companies like Tesla and PayPal entering the Bitcoin space, confidence in this digital asset has grown, and we might soon see increased use of Bitcoin as a payment method.

- Supply Reduction and Halving A unique feature of Bitcoin is its capped supply of 21 million units. Every four years, an event called “Halving” occurs, reducing the reward for Bitcoin mining by half. This leads to a decrease in new Bitcoin supply, increasing the likelihood of a Bull Run.

- Global Economic Conditions In uncertain economic conditions, many investors seek safe-haven assets. As a decentralized digital asset, Bitcoin can act as a secure store of value during such times. Economic crises, high inflation, and fiat currency fluctuations could drive increased demand and higher prices for Bitcoin.

- Technological Innovations Technological advancements in the Bitcoin network and its usability can also significantly impact the next Bull Run. For example, the adoption of the Lightning Network technology could improve Bitcoin transaction speed and cost, leading to increased usage.

- Institutional Investment Growth In recent years, there has been a noticeable increase in institutional investors entering the Bitcoin market. Large companies and investment funds are now considering Bitcoin as a viable asset for their portfolios. The influx of large capital into the market could have a significant impact on Bitcoin prices, fueling the next Bull Run.

Investment Strategies for the Next Bull Run

- Thorough Research and Analysis Before making any investment, it’s crucial to conduct thorough research and analysis of the market and its influencing factors. Reviewing past trends, and conducting technical and fundamental analysis can help you make better decisions.

- Risk Management Investing in Bitcoin comes with its own set of risks. Developing a risk management strategy and sticking to it can prevent significant losses. Proper capital allocation and setting stop-loss levels are key in this regard.

- Avoiding Emotional Decisions The cryptocurrency market is highly volatile, and emotional decisions can lead to substantial losses. Make an effort to base your decisions on data and logical analysis, avoiding the influence of market emotions and hype.

Conclusion

The next Bitcoin Bull Run could be driven by a range of factors, including wider adoption, supply reduction, and global economic conditions. However, the cryptocurrency market has always been unpredictable, and investors should approach it with caution and thorough analysis. Ultimately, success in Bitcoin investing hinges on your ability to understand the market, anticipate changes, and manage risk effectively.