What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to minimize price volatility by pegging their value to a stable asset, like a fiat currency (e.g., the US Dollar), a commodity (such as gold), or a basket of assets. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which can experience significant price swings, stablecoins aim to provide a more predictable and stable value. This stability makes them particularly appealing for use cases like remittances, payments, and as a safe harbor during periods of high market volatility.

Stablecoins have emerged as a crucial component of the cryptocurrency ecosystem, providing liquidity and acting as a bridge between fiat currencies and digital assets. But how exactly do they work, and what makes them different from other forms of cryptocurrency?

How Do Stablecoins Work?

Stablecoins achieve their stability by being backed by a reserve of assets that is held by a central authority or through algorithms that adjust supply based on demand. This reserve or mechanism provides a reference point that maintains the coin’s value at a steady rate.

There are different mechanisms through which stablecoins maintain their peg, including collateralization with assets or the use of algorithms that control supply. The choice of mechanism determines the type of stablecoin and its risk profile.

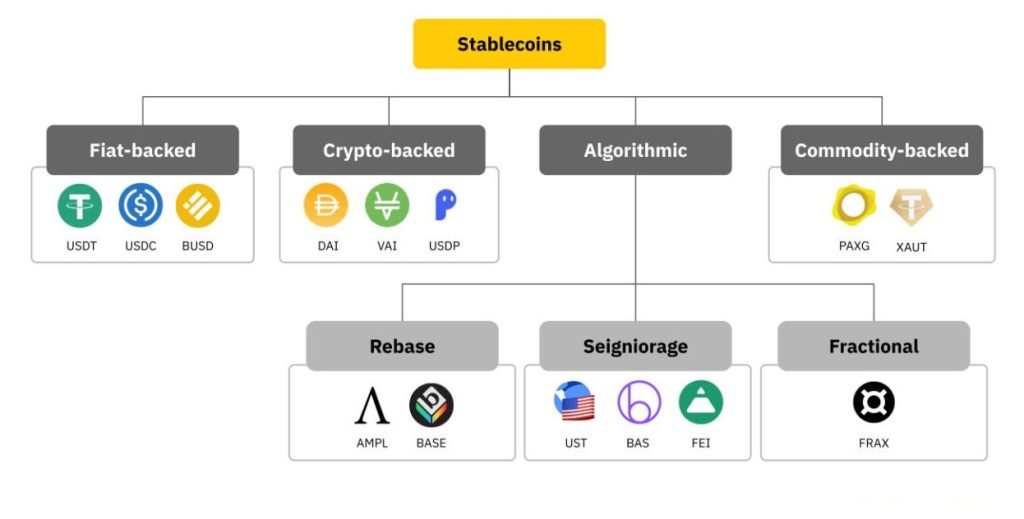

Types of Stablecoins

There are four main types of stablecoins, each with its own unique mechanism for maintaining value:

1. Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed by traditional fiat currencies like the US Dollar, Euro, or Yen. For every stablecoin issued, there is an equivalent amount of fiat currency held in reserve by a centralized institution, such as a bank or financial custodian. This reserve acts as a guarantee that the stablecoin can be redeemed for its face value.

- Examples: Tether (USDT), USD Coin (USDC), TrueUSD (TUSD)

- Pros: High stability, simple to understand, backed by real-world assets.

- Cons: Centralized, subject to regulatory scrutiny, dependent on the trustworthiness of the custodians.

2. Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed by a reserve of other cryptocurrencies rather than fiat money. To account for the volatility of the underlying cryptocurrencies, these stablecoins are often over-collateralized — meaning that the value of the cryptocurrency held in reserve exceeds the value of the stablecoins issued.

- Examples: Dai (DAI), sUSD (sUSD)

- Pros: Decentralized, transparent, can be more resistant to censorship.

- Cons: Collateral volatility, complex smart contract mechanisms, higher risk due to over-collateralization.

3. Algorithmic Stablecoins

Algorithmic stablecoins, also known as non-collateralized stablecoins, do not rely on a reserve of assets to maintain their value. Instead, they use algorithms and smart contracts to control the supply of the stablecoin in response to changes in demand, thereby maintaining a stable price.

- Examples: Ampleforth (AMPL), TerraUSD (UST – now defunct)

- Pros: Highly scalable, fully decentralized, not dependent on collateral.

- Cons: Vulnerable to market manipulation, high risk of failure if the algorithm fails to maintain the peg.

4. Commodity-Collateralized Stablecoins

Commodity-collateralized stablecoins are backed by reserves of tangible assets such as gold, silver, or other commodities. The value of these stablecoins is linked to the price of the underlying commodity.

- Examples: PAX Gold (PAXG), Digix Gold (DGX)

- Pros: Backed by tangible assets, provides a hedge against inflation.

- Cons: Dependent on the liquidity of the commodity market, centralized storage risks.

The Benefits of Stablecoins

Stablecoins offer several advantages that make them an attractive option for both individual users and institutions:

- Stability: Reduced price volatility compared to traditional cryptocurrencies.

- Accessibility: Easy to exchange across borders, enabling global transactions.

- Speed and Cost Efficiency: Lower fees and faster settlement times compared to traditional banking systems.

- Transparency and Security: Leveraging blockchain technology provides transparency and security for transactions.

- Use in Decentralized Finance (DeFi): Stablecoins are widely used in DeFi protocols for lending, borrowing, and yield farming.

Risks and Challenges of Stablecoins

Despite their benefits, stablecoins come with their own set of risks and challenges:

- Regulatory Risks: Governments and regulatory bodies are increasingly scrutinizing stablecoins, particularly fiat-collateralized ones, due to concerns over financial stability and money laundering.

- Centralization Risks: Many stablecoins are managed by centralized entities, which can pose risks related to trust and transparency.

- Collateralization Risks: The value of collateralized stablecoins is directly tied to the assets held in reserve, which can fluctuate in value or face liquidity issues.

- Algorithmic Risks: Algorithmic stablecoins are especially vulnerable to volatility and can potentially collapse if market conditions change unexpectedly.

Popular Stablecoins in the Market

Several stablecoins have gained significant traction in the market. Here are some of the most popular:

- Tether (USDT): The largest and most widely used stablecoin, pegged to the US Dollar.

- USD Coin (USDC): A popular fiat-collateralized stablecoin backed by Circle and Coinbase.

- Dai (DAI): A decentralized, crypto-collateralized stablecoin issued by the MakerDAO protocol.

- PAX Gold (PAXG): A commodity-collateralized stablecoin backed by gold.

Regulation of Stablecoins

Regulation is one of the most significant challenges facing the stablecoin market today. Governments worldwide are working to establish frameworks to regulate stablecoins, primarily to address concerns around financial stability, consumer protection, and anti-money laundering. Some regulatory bodies propose classifying stablecoins as securities, which would subject them to stricter oversight.

The Future of Stablecoins

The future of stablecoins is bright but uncertain. As the cryptocurrency ecosystem continues to evolve, stablecoins are likely to play an increasingly important role. They offer a bridge between traditional financial systems and the digital economy, facilitating faster, cheaper, and more accessible transactions.

However, their future will depend on several factors, including regulatory developments, technological advancements, and the broader adoption of digital currencies by both consumers and businesses.

Conclusion

Stablecoins are an innovative and evolving class of cryptocurrencies that provide stability in an otherwise volatile market. By understanding the different types of stablecoins and their respective advantages and risks, you can better navigate the ever-changing world of digital finance. Whether you are an investor, a business owner, or just someone interested in the future of money, keeping an eye on the development of stablecoins is crucial as they are likely to be a key component in the digital economy of the future.