Cryptocurrency mining has evolved from a niche activity to a global phenomenon, driving both excitement and controversy. If you’re considering diving into this world, it’s essential to understand the various aspects of mining, from the types of cryptocurrencies you can mine to the impact this activity has on the environment and economy. This guide will walk you through everything you need to know about cryptocurrency mining, breaking down the complex details in a way that’s easy to grasp. Whether you’re a beginner or a seasoned crypto enthusiast, there’s something valuable for you here.

Types of Mineable Cryptocurrencies

The world of cryptocurrency is vast, but not all digital currencies are mineable. Some cryptocurrencies rely on mechanisms like staking, while others are based on proof-of-work (PoW) algorithms, which require mining. Here are some of the most common mineable cryptocurrencies:

Bitcoin (BTC)

Bitcoin (BTC)

- Launched: January 3, 2009

- How to Mine: Bitcoin mining relies on the Proof-of-Work (PoW) algorithm called SHA-256. Due to Bitcoin’s popularity and increased mining difficulty, miners predominantly use ASICs (Application-Specific Integrated Circuits), as CPU and GPU mining are no longer profitable. You can mine individually or join mining pools to increase your chances of earning rewards.

- Market Cap: As of 2024, Bitcoin boasts a market cap of over $500 billion, making it the largest cryptocurrency by market capitalization.

- Average Daily Volume: Bitcoin sees billions of dollars traded daily, with volumes fluctuating between $15 billion to $25 billion, depending on market conditions.

- Exchanges: Bitcoin is listed on almost every cryptocurrency exchange globally, including Binance, Coinbase, Kraken, Bitfinex, and Gemini.

- Profitability: Bitcoin mining is still profitable, but due to halving events (which occur every 4 years, reducing block rewards by half) and rising electricity costs, it has become more difficult for smaller miners. Larger mining farms with access to cheap electricity are the major players in this space.

Ethereum (ETH)

Ethereum (ETH)

- Launched: July 30, 2015

- How to Mine: Ethereum mining uses the Ethash PoW algorithm, which is still widely mined with GPUs. However, Ethereum is transitioning to Proof-of-Stake (PoS) with Ethereum 2.0, and mining will eventually phase out. For now, miners can still profit by using high-performance GPUs like Nvidia’s RTX 30 series or AMD’s RX series.

- Market Cap: As of 2024, Ethereum’s market cap exceeds $200 billion, making it the second-largest cryptocurrency by market value.

- Average Daily Volume: Ethereum experiences high trading volume, averaging between $5 billion to $15 billion daily.

- Exchanges: Available on almost every exchange, Ethereum can be traded on platforms like Coinbase, Binance, Kraken, and Bitstamp.

- Future Mining: Ethereum mining is expected to end entirely once Ethereum 2.0’s PoS system fully takes over. Many miners are preparing to shift to other GPU-mineable coins.

Litecoin (LTC)

Litecoin (LTC)

- Launched: October 7, 2011

- How to Mine: Litecoin utilizes the Scrypt algorithm, which is less power-intensive compared to Bitcoin’s SHA-256. This makes Litecoin more accessible to smaller miners using ASIC miners like Antminer L3+. Like Bitcoin, Litecoin can be mined individually or through mining pools such as Litecoinpool.org or F2Pool.

- Market Cap: Litecoin currently holds a market cap of approximately $6 billion.

- Average Daily Volume: The daily trading volume for Litecoin typically ranges from $300 million to $1 billion.

- Exchanges: Litecoin is available on most exchanges, including Binance, Coinbase, Kraken, and Huobi.

- Profitability: While Litecoin mining is generally more accessible than Bitcoin, profitability depends on electricity costs and hardware efficiency. Mining pools can help increase chances of consistent rewards.

Monero (XMR)

Monero (XMR)

- Launched: April 18, 2014

- How to Mine: Monero uses the RandomX algorithm, which is ASIC-resistant, making it ideal for mining with CPUs and GPUs. Miners favor this coin for its focus on privacy and anonymity. You can mine Monero using popular mining software like XMRig or join mining pools such as MoneroOcean.

- Market Cap: As of 2024, Monero’s market cap hovers around $2.5 billion, securing its place as a top privacy-focused cryptocurrency.

- Average Daily Volume: Monero’s daily volume fluctuates around $50 million to $150 million, depending on market conditions.

- Exchanges: Monero is listed on major exchanges like Binance, Kraken, and OKX, though some exchanges exclude it due to privacy concerns and regulatory issues.

- Profitability: Monero remains one of the most profitable CPU-mineable coins due to its ASIC resistance. Mining is viable for smaller setups, especially if you’re joining pools to combine hashing power.

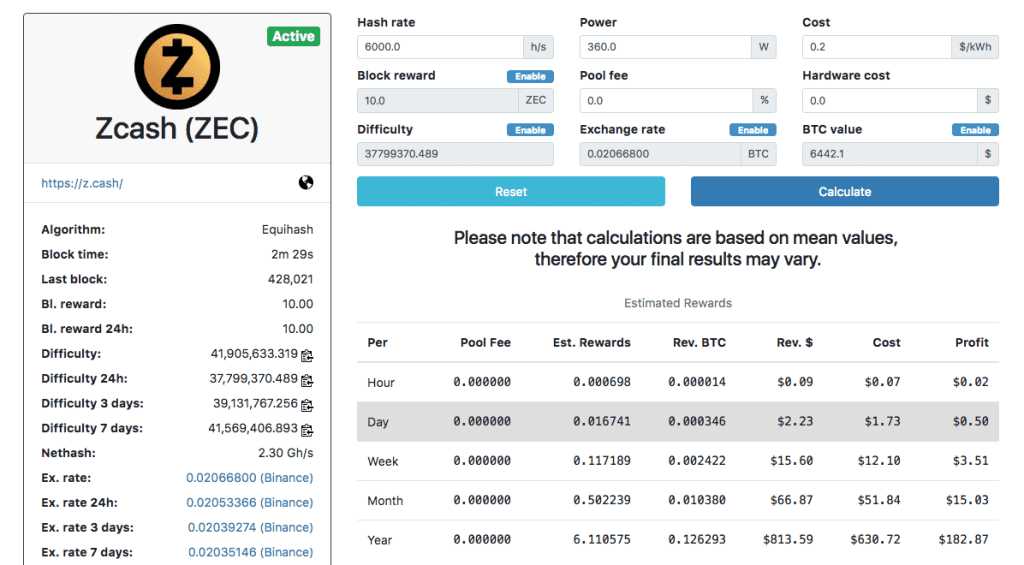

Zcash (ZEC)

Zcash (ZEC)

- Launched: October 28, 2016

- How to Mine: Zcash employs the Equihash mining algorithm, which is optimized for GPU mining. Nvidia GPUs are popular among miners due to their superior performance with this algorithm. Zcash mining is available through mining pools like Flypool or 2Miners.

- Market Cap: Zcash’s market cap is around $450 million, with its privacy features attracting a niche community of supporters.

- Average Daily Volume: Zcash sees an average daily trading volume of $40 million to $100 million.

- Exchanges: Zcash is available on most large exchanges, such as Binance, Coinbase, Gemini, and Kraken.

- Profitability: Zcash mining is popular among GPU miners due to its privacy features and less competitive mining environment compared to Bitcoin. However, as with other coins, electricity costs and the price of ZEC significantly impact profitability.

Dogecoin (DOGE)

Dogecoin (DOGE)

- Profitability: Mining Dogecoin can still be profitable, especially for miners using Scrypt-based ASICs. However, as with any cryptocurrency, profitability depends on market price, mining difficulty, and electricity costs.

- Launched: December 6, 2013

- How to Mine: Dogecoin shares the Scrypt mining algorithm with Litecoin, allowing miners to mine both simultaneously using merged mining techniques. Most Dogecoin miners use ASICs like the Antminer L3+. You can mine DOGE solo or join mining pools like Multipool or ProHashing.

- Market Cap: Dogecoin’s market cap as of 2024 is approximately $10 billion, largely driven by community support and high-profile endorsements from figures like Elon Musk.

- Average Daily Volume: Dogecoin trades with a daily volume of $500 million to $1 billion, often driven by social media hype.

- Exchanges: Dogecoin is listed on all major exchanges, including Binance, Robinhood, Kraken, and eToro.

Mining Methods

Mining cryptocurrencies can be done in several ways, depending on the hardware and software you use. The three primary methods are:

CPU Mining

This method utilizes a regular computer’s CPU (central processing unit). While CPU mining was popular in the early days of Bitcoin, it’s now largely inefficient due to the increasing complexity of mining algorithms.

GPU Mining

Graphics processing units (GPUs) are more powerful than CPUs and are commonly used for mining altcoins like Ethereum, Litecoin, and others. GPU mining remains a popular option for smaller miners because it strikes a balance between efficiency and cost.

ASIC Mining

Application-Specific Integrated Circuit (ASIC) miners are custom-built machines designed for mining specific cryptocurrencies. They’re highly efficient for mining Bitcoin and other cryptocurrencies but come with high upfront costs. ASICs dominate the Bitcoin mining landscape.

Cloud Mining

If you don’t want to invest in hardware, cloud mining allows you to rent mining power from a remote data center. While convenient, it’s often less profitable due to fees and potential risks from untrustworthy providers.

Mining Hardware

The choice of hardware directly impacts the efficiency and profitability of cryptocurrency mining. Here’s a breakdown of the main types:

CPUs

Best suited for smaller cryptocurrencies or when mining coins like Monero that resist specialized hardware. However, it’s becoming less practical due to competition.

GPUs

Favored for mining altcoins, GPUs offer flexibility and can mine multiple coins. Popular choices include Nvidia and AMD graphics cards, which are readily available to most users.

ASICs

Designed for large-scale mining, ASIC machines offer unparalleled efficiency for specific cryptocurrencies like Bitcoin. However, their high cost and energy consumption make them less accessible to smaller miners.

FPGA (Field-Programmable Gate Array)

Though not as widely used as ASICs or GPUs, FPGAs offer customizable hardware configurations that are more energy-efficient. They strike a middle ground but require more technical knowledge to configure.

Mining Software

The software you use for mining is just as important as the hardware. The right software optimizes your mining efficiency and can help you stay profitable. Popular mining software includes:

CGMiner

One of the oldest and most widely used Bitcoin mining software, CGMiner supports GPU, FPGA, and ASIC mining. It’s compatible with several cryptocurrencies.

NiceHash

A marketplace for hash power, NiceHash allows users to buy and sell computing power. It’s simple to use, making it a good choice for beginners.

Claymore

Popular for Ethereum mining, Claymore offers dual mining options, allowing you to mine two coins at once (e.g., Ethereum and Decred).

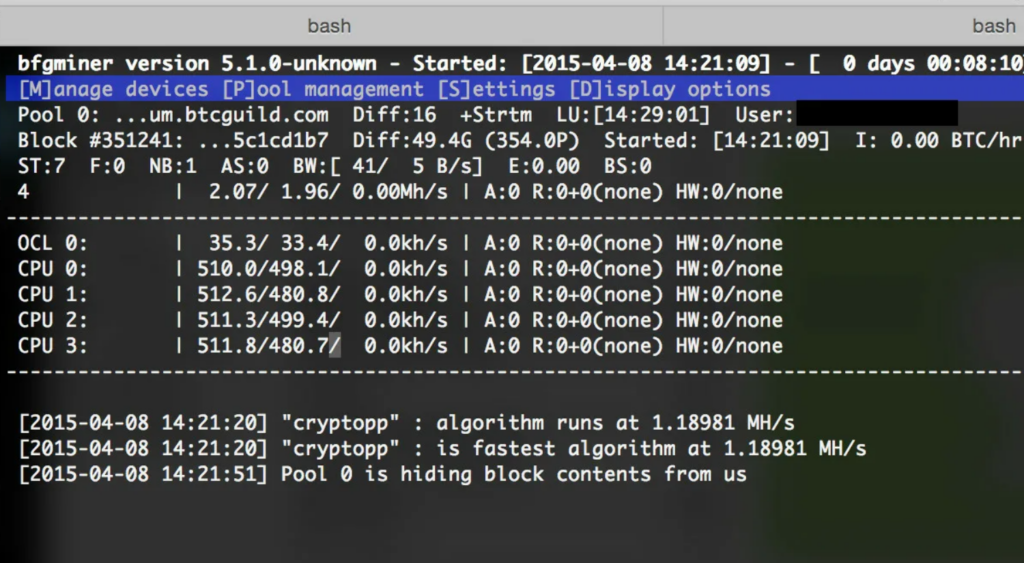

BFGMiner

Similar to CGMiner but focused on FPGA and ASIC mining, BFGMiner is another popular choice for those who want more control over their mining setup.

Minergate

A user-friendly mining software that supports CPU and GPU mining for a variety of coins.

Economic Considerations

Mining profitability hinges on several factors, including electricity costs, hardware prices, and the current market value of the cryptocurrency being mined. Here’s what to keep in mind:

- Electricity Costs: Mining is energy-intensive, especially with ASIC machines. Lower electricity costs can significantly boost profitability.

- Hardware Costs: The price of GPUs and ASICs can fluctuate depending on demand and availability, especially during cryptocurrency booms.

- Difficulty and Block Rewards: Mining becomes more difficult as more people participate, reducing the chances of solving a block. Block rewards also decrease over time (e.g., Bitcoin’s halving event).

- Market Price of Cryptocurrencies: Mining becomes more profitable when cryptocurrency prices are high, but during market downturns, many miners struggle to break even.

Environmental Impact of Mining

One of the most hotly debated topics in cryptocurrency is its environmental impact. Mining consumes vast amounts of electricity, leading to concerns about its contribution to carbon emissions and environmental degradation.

- Energy Consumption: Bitcoin mining, in particular, uses more electricity annually than entire countries. This has led to criticism of PoW-based cryptocurrencies.

- Sustainable Alternatives: Some cryptocurrencies are shifting to more eco-friendly models like proof-of-stake (PoS) to reduce energy consumption. Ethereum’s transition to Ethereum 2.0 is a prime example.

- Green Mining Solutions: Some companies and individuals are seeking ways to use renewable energy for mining, reducing the environmental footprint of the industry.

Regulations and Legal Issues

Cryptocurrency mining exists in a regulatory gray area in many countries. Here are some legal considerations to be aware of:

- Legal Status: While cryptocurrency mining is legal in many countries, others like China have banned it due to concerns over electricity consumption and financial risks.

- Taxes: Mining is typically considered taxable income. Be sure to consult local tax laws to understand how mining income should be reported.

- Government Crackdowns: Some governments have taken action against illegal mining operations, especially those that steal electricity or operate without permission.

Future of Cryptocurrency Mining

The future of mining is constantly evolving. Here are some key trends to watch:

- Proof-of-Stake (PoS): As Ethereum and other coins transition to PoS, mining could become less relevant. Staking doesn’t require hardware, making it a more accessible and energy-efficient way to secure networks.

- New Mining Algorithms: To address concerns over centralization and ASIC dominance, some cryptocurrencies are developing algorithms designed to be ASIC-resistant, such as Monero’s RandomX.

- Eco-Friendly Innovations: Expect more innovations aimed at reducing the environmental impact of mining, including green energy initiatives and carbon offsets.

- Quantum Computing: As quantum computing becomes more advanced, it could either revolutionize mining or render it obsolete, depending on how blockchain technology adapts.

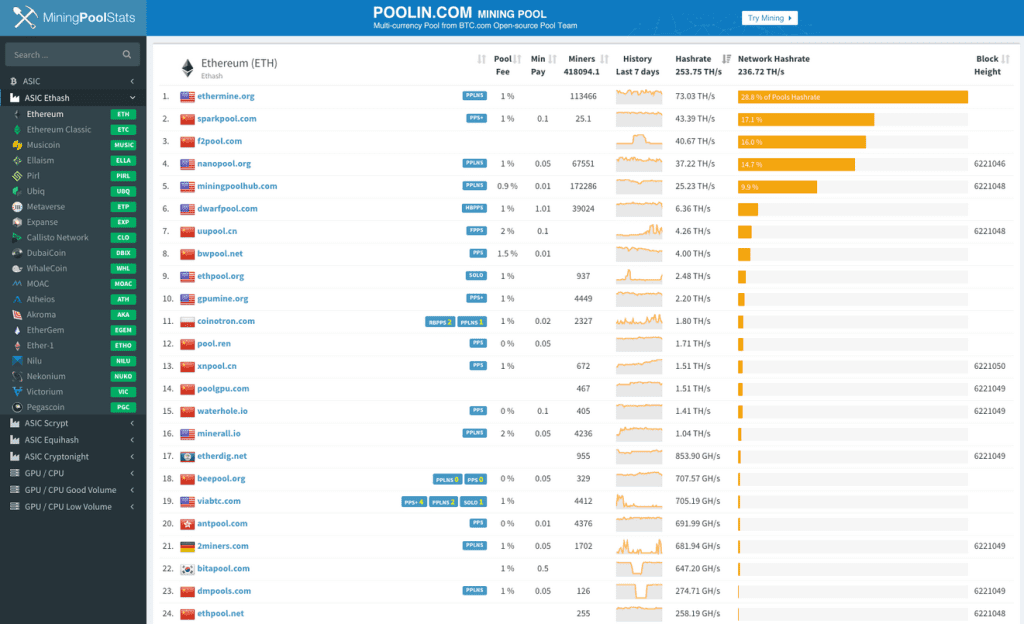

Mining Pools

Joining a mining pool allows miners to pool their resources together to increase their chances of earning rewards. Here’s why they matter:

What is a Mining Pool?

A mining pool combines the hashing power of many miners, distributing rewards proportionally based on the work contributed.

Pros and Cons

While mining pools increase your chances of earning, they also mean sharing profits. However, for smaller miners, it’s often the only way to earn consistent payouts.

Popular Pools

Some of the most well-known mining pools include Slush Pool, AntPool, and F2Pool. Each pool has different fees, payout structures, and minimum withdrawal limits.

Difference Between Mining and Trading

It’s important to understand the distinction between mining and trading when entering the cryptocurrency space.

- Mining: Mining involves validating transactions and securing the blockchain network by solving complex mathematical problems. In return, miners are rewarded with newly minted coins.

- Trading: Trading involves buying and selling cryptocurrencies on exchanges. It doesn’t require hardware or software but relies on market knowledge and timing to make a profit.

Both mining and trading have their risks and rewards, and deciding which one to pursue largely depends on your skillset, resources, and risk tolerance.

Final Thoughts

Cryptocurrency mining is a complex but fascinating aspect of the digital asset world. Whether you’re interested in mining Bitcoin with ASICs or experimenting with GPU mining for altcoins, it’s essential to understand the hardware, software, and economic factors at play. Moreover, the environmental and regulatory landscape continues to evolve, with potential impacts on the future of mining. Ultimately, success in mining requires not only technical knowledge but also a clear strategy to navigate the ever-changing crypto market.